Your Double top stock pattern images are ready. Double top stock pattern are a topic that is being searched for and liked by netizens now. You can Download the Double top stock pattern files here. Find and Download all free images.

If you’re searching for double top stock pattern images information related to the double top stock pattern keyword, you have pay a visit to the ideal blog. Our site always provides you with suggestions for viewing the maximum quality video and image content, please kindly surf and find more enlightening video content and images that fit your interests.

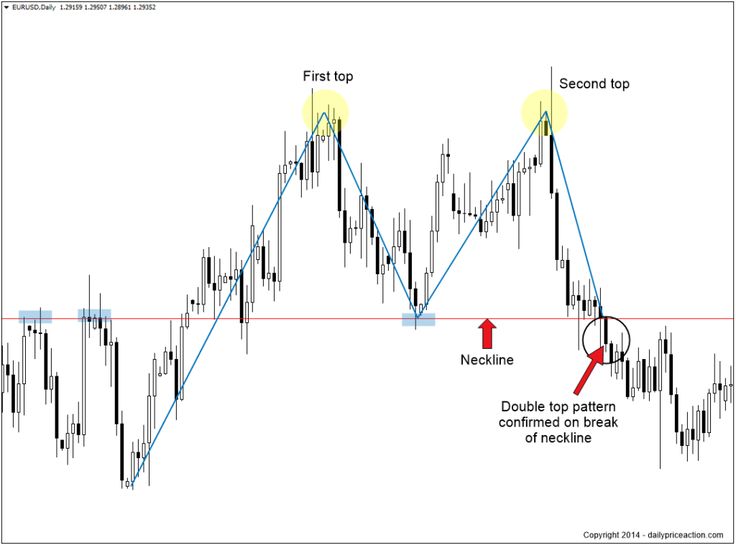

Double Top Stock Pattern. Double Top A double top is a reversal pattern that is formed after there is an extended move up. It signals that the market is unable to break through a key resistance level. Auto Refresh during market hours. The share market Screener of NSE will analyse the selected data for all listed stocks of.

Double Top Chart Pattern Trading Charts Stock Chart Patterns Technical Analysis Charts From pinterest.com

Double Top Chart Pattern Trading Charts Stock Chart Patterns Technical Analysis Charts From pinterest.com

Then finally were trying to move higher into higher prices in 2013. This pattern is formed with two peaks above a support level which is also known as the neckline. In comparison the decline in price shows a. It causes prices to rise. Double Top A double top is a reversal pattern that is formed after there is an extended move up. Lets take a look on screen at this double top reversal pattern.

The Double Top Reversal is a bearish reversal pattern typically found on bar charts line charts and candlestick charts.

After reaching a peak point there will be a sudden decrease in price level up to a certain amount. It signals that the market is unable to break through a key resistance level. NSE Daily chart Screener. We didnt do so well and you can see that around August. For years traders have claimed that the double top pattern is a high probability short setup. Example of Double Top Reversal Pattern Groupon.

Source: pinterest.com

Source: pinterest.com

The formation shows the 2 major highs of the stock over a period from where it previously saw selling pressure. The Double Top is a standard pattern with two highs and one low to form a reversal pattern. It is confirmed once the assets price falls below a support level equal to the low between the two prior highs. A double top pattern confirmation occurs at the breakdown from the neckline with larger volumes. It signals that the market is unable to break through a key resistance level.

Source: pinterest.com

Source: pinterest.com

It is confirmed once the assets price falls below a support level equal to the low between the two prior highs. Failure to again cross them. Double top is a trend reversal chart pattern formed after good bullish price move a continuous price move for a good duration where the upward price movement looses its steam first top and it retraces a bit to neck line or mid point. Auto Refresh during market hours. Filter Patterns on a pre-created stock basket like NSE 500 Midcap smallcap.

Source: pinterest.com

Source: pinterest.com

A double top pattern confirmation occurs at the breakdown from the neckline with larger volumes. Chart Patterns Double Bottom Double Top Reverse Head and Shoulders Head and Shoulders Falling Wedge Rising Wedge Round Bottoms Down Channel Up Channel Flag Up Trend Flag down Trend Triangle. This is because a double top signifies that bulls are having trouble pushing the price past the prior high. This pattern is formed with two peaks above a support level which is also known as the neckline. Screener NSE Stocks forming Double Top patterns.

Source: pinterest.com

Source: pinterest.com

If it is a clear breakout above 8400 then possibility of more upside. Failure to again cross them. For years traders have claimed that the double top pattern is a high probability short setup. It is confirmed once the assets price falls below a support level equal to the low between the two prior highs. After hitting this level the price will bounce off it slightly.

Source: pinterest.com

Source: pinterest.com

The central part of the pattern is the dropping of the price between two highs. It is confirmed once the assets price falls below a support level equal to the low between the two prior highs. There are some new regulations coming for EV in auto industry It will be interesting to watch this out. Screener NSE Stocks forming Double Top patterns. The double top is a reversal pattern which typically occurs after an extended move up.

Source: pinterest.com

Source: pinterest.com

The more difficulty a. Double Top Pattern A double top pattern is formed from two consecutive rounding tops. Auto Refresh during market hours. Double top is a trend reversal chart pattern formed after good bullish price move a continuous price move for a good duration where the upward price movement looses its steam first top and it retraces a bit to neck line or mid point. Short trade can be initiated below the swing low at the neckline.

Source: pinterest.com

Source: pinterest.com

For years traders have claimed that the double top pattern is a high probability short setup. We didnt do so well and you can see that around August. Example of Double Top Reversal Pattern Groupon. The double top pattern can give us good risk-to-reward ratios to trade and hence they are one of the most important patterns. Double Top A double top is a reversal pattern that is formed after there is an extended move up.

Source: pinterest.com

Source: pinterest.com

It forms after an asset gets to a high price two consecutive times with a moderate decline between the two highs just as its name indicates. There are some new regulations coming for EV in auto industry It will be interesting to watch this out. Double Top helps to know the immediate resistance level for a stock. A double top chart pattern is a bearish reversal chart pattern that is formed after an uptrend. For example filter Bullish Engulfing on Midcap stocks.

Source: br.pinterest.com

Source: br.pinterest.com

This is because a double top signifies that bulls are having trouble pushing the price past the prior high. Sometimes called an M formation because of the pattern it creates on the chart the double top. Filter Patterns on a Custom stock basket like watchlist portfolio. The first rounding top forms an upside-down U pattern. Maruti is showing signs of Double Top pattern as it is at crucial resistance zone.

Source: pinterest.com

Source: pinterest.com

This pattern is formed with two peaks above a support level which is also known as the neckline. NSE Daily chart Screener. Lets take a look on screen at this double top reversal pattern. The trend is then reversed and the sellers in the market begin to prevail subsequently with the supply overtaking the demand. If it falls from here it could move down forming Double Top pattern.

Source: pinterest.com

Source: pinterest.com

After reaching a peak point there will be a sudden decrease in price level up to a certain amount. It is confirmed once the price of the asset falls below a specific support level equal to the low between the two prior highs. You can see from the stock we first sold off around 2012. The central part of the pattern is the dropping of the price between two highs. This pattern is formed with two peaks above a support level which is also known as the neckline.

Source: in.pinterest.com

Source: in.pinterest.com

Double Top A double top is a reversal pattern that is formed after there is an extended move up. The double top pattern tells an investor trader or analyst that the buyers in the market are prevailing and as such the demand is overtaking the supply up until the formation of the first top. Double top is a trend reversal chart pattern formed after good bullish price move a continuous price move for a good duration where the upward price movement looses its steam first top and it retraces a bit to neck line or mid point. The formation shows the 2 major highs of the stock over a period from where it previously saw selling pressure. The Double Top Reversal is a bearish reversal pattern typically found on bar charts line charts and candlestick charts.

Source: pinterest.com

Source: pinterest.com

It signals that the market is unable to break through a key resistance level. The central part of the pattern is the dropping of the price between two highs. As the supply surpasses. The double top pattern tells an investor trader or analyst that the buyers in the market are prevailing and as such the demand is overtaking the supply up until the formation of the first top. For years traders have claimed that the double top pattern is a high probability short setup.

Source: pinterest.com

Source: pinterest.com

BTCUSD Possible Double Top on Weekly Chart A double top is an extremely bearish technical reversal pattern that forms after an asset reaches a high price two consecutive times with a moderate decline between the two highs. Alert sound during market hours. The Double Top Reversal is a bearish reversal pattern typically found on bar charts line charts and candlestick charts. The double top is a reversal pattern of an upward trend in a stocks price. A double top chart pattern is a bearish reversal chart pattern that is formed after an uptrend.

Source: pinterest.com

Source: pinterest.com

As its name implies the pattern is made up of two consecutive peaks that are roughly equal with a moderate trough in-between. There are three parts to a double top. The trend is then reversed and the sellers in the market begin to prevail subsequently with the supply overtaking the demand. The first rounding top forms an upside-down U pattern. The double top marks an uptrend in the process of becoming a downtrend.

Source: pinterest.com

Source: pinterest.com

Screener NSE Stocks forming Double Top patterns. As the supply surpasses. We didnt do so well and you can see that around August. It is confirmed once the assets price falls below a support level equal to the low between the two prior highs. Sometimes called an M formation because of the pattern it creates on the chart the double top.

Source: pinterest.com

Source: pinterest.com

Select data to use select what to screen and click Screener button. Add alert on pattern both Intraday and EOD. After hitting this level the price will bounce off it slightly. Auto Refresh during market hours. BTCUSD Possible Double Top on Weekly Chart A double top is an extremely bearish technical reversal pattern that forms after an asset reaches a high price two consecutive times with a moderate decline between the two highs.

Source: pinterest.com

Source: pinterest.com

First top Second top Neckline A double top is only confirmed once the market closes back below neckline support. What is Double Top Pattern. The two highs are known as tops and show a resistance line. Auto Refresh during market hours. Alert sound during market hours.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title double top stock pattern by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.